Insurance companies encounter limitations in their opportunities to engage with customers, compelling them to maximize the value of each interaction by tailoring recommendations to suit individual needs. However, despite this targeted approach, insurers frequently experience suboptimal conversion rates, highlighting the ongoing challenge of fully capitalizing on their limited customer interactions. Moreover, managing conversion rates across large sales organizations, which often comprise hundreds of agents, introduces additional layers of complexity and coordination hurdles for insurers to navigate. As such, optimizing conversion rates while effectively coordinating offers across diverse agent networks remains a multifaceted challenge within the insurance industry.

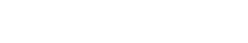

AI serves as a valuable tool for insurers and their agents, enhancing their ability to optimize conversion rates by presenting customers and prospects with tailored product recommendations that align with their preferences and likelihood of acceptance. This strategic approach enables insurers to maximize the Annual Premium Equivalent (APE) of sales facilitated by agents, as they can effectively leverage each interaction with customers to offer the most relevant products.

In the insurance industry, ensuring that customers are presented with products they are eligible to accept is paramount. To achieve this, AI models are integrated with Business Rules Management Systems (BRMS), which are designed to implement predefined rules determining a customer's eligibility for specific products. Unlike AI models, which rely on probabilistic interpretations, rules engines offer a more deterministic approach by applying hard-coded rules to assess eligibility. Once the rules engine filters out products for which the customer is ineligible, the AI model then ranks the remaining options based on their probability of acceptance, thereby streamlining the product recommendation process and enhancing customer engagement.

To effectively gauge the return on investment (ROI), a comprehensive A/B test can be conducted to assess the efficacy of implementing AI/machine learning-driven recommendations in sales conversations. This test involves the random assignment of sales agents into two distinct groups: the treatment group and the control group. Sales agents in the treatment group are equipped with AI-driven insights to inform their offer recommendations during sales interactions, while those in the control group continue to employ the existing method for making such recommendations.

Following the implementation of the test, the performance of the two groups is meticulously measured and compared. Given the anticipated discrepancy in sales performance between the treatment and control groups, adjustments to the key performance indicators (KPIs) of agents in the control group may be warranted to accurately reflect the impact of the AI-driven approach.

Furthermore, the adoption of next best offer (NBO) use cases by insurers has yielded substantial revenue uplifts, ranging from $5,000,000 to $15,000,000 in the inaugural year alone. This increase in revenue is primarily attributed to a notable enhancement in cross-sell revenue, with a reported uptick of approximately 10% to 20% compared to previous approaches. Such significant revenue gains underscore the transformative potential of leveraging AI-driven recommendations in sales processes, demonstrating its ability to drive tangible business outcomes and bolster organizational growth.

Copyright © 2023 Wizio AI